Framework

In particular, the PSD2 governs other activities of PSPs in the European market of payment services by introducing three service models, under which new players can build the services they offer.

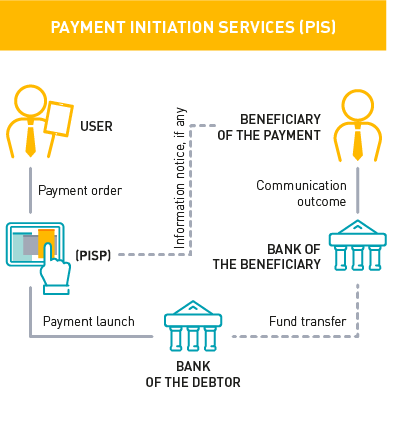

ASPSP are obliged to receive and manage payment orders initiated by its customers through PISP that are qualified to operate in the European Union

PISPs can offer to customers of the ASPSPs initialisation services for payment orders directed to all ASPSPs in which they have payment accounts

PISPs are authorised exclusively to operate the new payment service and never to enter into possession of the funds of the debtor

ASPSPs are obliged to provide payment account information upon request of their customers that are users of those AISPs authorised to work in the European Union

AISPs can offer customers of ASPSPs information aggregation services on payment accounts that are held by the ASPSPs

AISPs cannot use customer data or access the payment accounts for purposes other than those provided by the service authorised by the customer

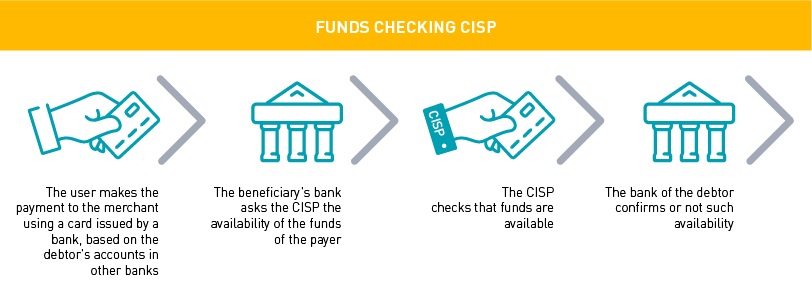

CISPs can make a request to the ASPSP of the user for the availability of funds before the execution of the card-based payment

The request can take place only if the account of the debtor is accessible online and if he had previously issued the consent to the ASPSP – Account Servicing Payment Service Provider – and to the CISP

The answer can only be positive or negative and the CISP will never be aware of the extract of the balance, or memorise the response or use it for any purpose other than the execution of the card-based payment transaction

The PSD2 is a potential forge for creating innovative transactional products and services that will be increasingly in line with the digitisation and evolution of customers. In this sense, the market evolution will be considerable, and to date not entirely conceivable, also thanks to the expansion of the Fintech scenario.

powered by CBI S.c.p.a. Benefit Corporation - Fiscal Code 97249640588 - VAT Identification 08992631005 - LEI Code 52670099B6D3C3176A75

Framework

Framework